Japanese media giant KADOKAWA has reported a sharp decline in profits for the third quarter of the fiscal year ending March 2026, with its publishing business posting a staggering 90% drop in profit and its anime division falling into an operating loss.

The company released its consolidated earnings on February 12, revealing a significant year-on-year downturn across multiple key segments.

Overall Financial Results (Q3 FY2026)

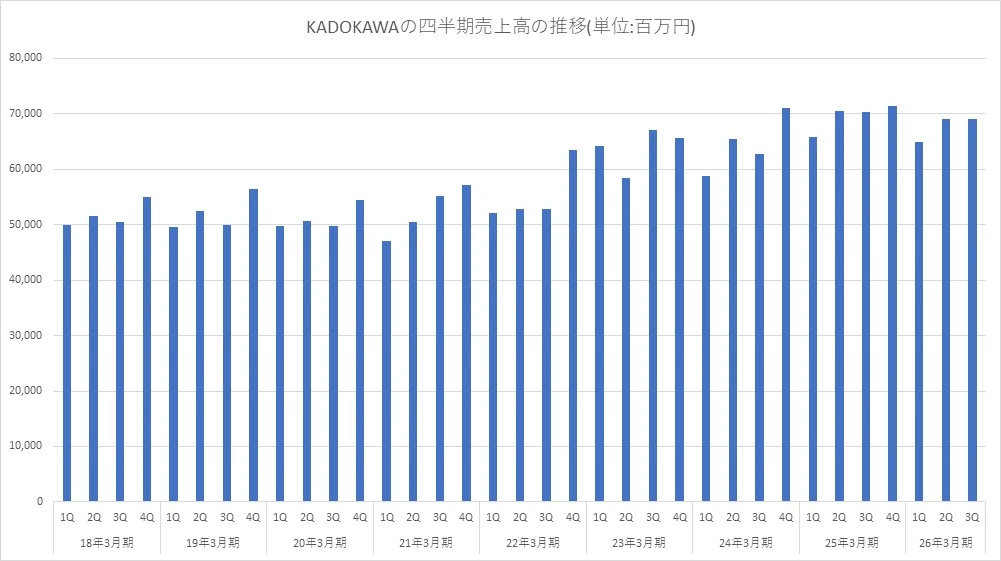

For the cumulative third quarter:

- Revenue: ¥202.99 billion (down 1.7% year-on-year)

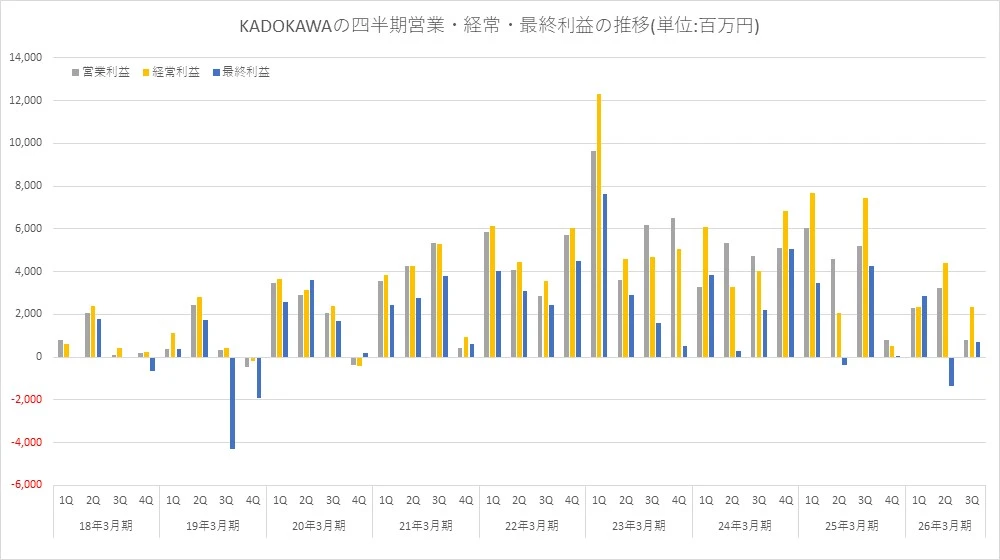

- Operating Profit: ¥6.377 billion (down 59.7%)

- Ordinary Profit: ¥9.107 billion (down 47.1%)

- Net Profit: ¥2.211 billion (down 70.0%)

While overall revenue remained relatively stable, profitability sharply declined due to weaker publishing performance and losses in the anime and live-action segment.

Publishing & IP Creation: Profit Down 90%

KADOKAWA’s core Publishing and IP Creation business reported:

- Revenue: ¥111.68 billion (flat year-on-year)

- Operating Profit: ¥623 million (down 90.2%)

The company attributed the decline primarily to:

- Smaller average sales per title in Japan

- Fewer major hit titles in digital publishing

- Changes in revenue recognition timing for e-books

- Increased personnel expenses

Although overseas performance in the U.S. and Asia remained strong, supported by new international offices established in the past year, domestic sales weakened as individual titles generated smaller-scale revenues compared to previous periods.

Digital publishing also declined, partly because the prior year benefited from estimated sales reporting adjustments that boosted figures.

The sharp profit drop in publishing significantly impacted overall group performance.

Anime & Live-Action Division Turns Red

The Anime and Live-Action segment recorded:

- Revenue: ¥31.63 billion (down 16.6%)

- Operating Loss: ¥904 million

This marks a major reversal from the previous year, when the segment posted ¥4.7 billion in operating profit.

According to KADOKAWA, the decline was driven by:

- A higher ratio of first-time anime adaptations in the lineup

- Fewer large-scale blockbuster titles compared to last year

- Reduced secondary revenue from previously released theatrical films

While some theatrical releases contributed through media-mix strategies, they were unable to offset the absence of major franchise titles that had boosted results in the prior fiscal year.

The shift from strong profitability to operating loss highlights increasing volatility in anime project performance.

Games, Education, Web Services And More

The Game segment reported:

- Revenue: ¥23.38 billion (down 11.6%)

- Operating Profit: ¥8.05 billion (down 7.0%)

Although ELDEN RING NIGHTREIGN performed strongly both domestically and internationally, the previous fiscal year benefited heavily from sales of ELDEN RING and its DLC Shadow of the Erdtree. With that surge now stabilizing, the segment experienced expected declines.

The Web Services business showed strong recovery:

- Revenue: ¥16.24 billion (up 21.5%)

- Operating Profit: ¥2.187 billion

The rebound was largely due to recovery from last year’s cyberattack impacts on video community services, as well as successful events such as large-scale anime and entertainment conventions. Lower IT infrastructure costs also improved profitability.

The Education and EdTech segment delivered steady growth:

- Revenue: ¥12.83 billion (up 13.4%)

- Operating Profit: ¥2.51 billion (up 10.9%)

Growth was driven by:

- Increased student enrollment at Vantan creative schools

- Expansion of KADOKAWA’s Anime & Voice Actor Academy

- Continued growth of N High School, S High School, R High School, and ZEN University

For the full fiscal year ending March 2026, KADOKAWA forecasts:

- Revenue: ¥278.2 billion (up 0.1%)

- Operating Profit: ¥10.3 billion (down 38.1%)

- Ordinary Profit: ¥12.4 billion (down 30.1%)

- Net Profit: ¥4.9 billion (down 33.7%)

As of Q3, progress toward full-year targets stands at:

- Revenue: 73.0%

- Operating Profit: 61.9%

- Net Profit: 45.1%

What This Means for the Anime Industry

The most notable development is the anime division’s move into operating loss, combined with a 90% drop in publishing profit, traditionally KADOKAWA’s foundation for generating new IP.

With fewer breakout hits and smaller average title performance, future adaptation pipelines and investment strategies could face tighter scrutiny. The shift toward first-time anime adaptations also suggests higher risk exposure compared to established franchise sequels.

While web services and education continue to expand, the company’s creative content businesses, publishing and anime, are currently under significant profitability pressure.

How this trend affects future anime production volumes and IP development will be closely watched in the coming quarters.

Source: Gamebiz